Check 31+ pages capital loss carryover worksheet 2016 to 2017 answer in Doc format. 262016 California Capital Gain or Loss Adjustment SCHEDULE D 540NR Names as shown on return. 262017 California Capital Gain or Loss Adjustment SCHEDULE Do not complete this schedule if all of your California gains losses are the same as your federal gains losses. If zero or less enter -0-Enter the loss from your 2016 Schedule D line 15 as a positive amount Enter any gain from your 2016 Schedule D line 7. Read also worksheet and capital loss carryover worksheet 2016 to 2017 Use the Capital Loss Carryover Worksheet in the 2020 Schedule D.

For the year 2017 I had yyyyy profit. Subtract line 7 from line 5.

Fillable Schedule D Form 1040 Capital Gains And Losses 2012 Printable Pdf Download Schedule D NOL Carryover from 2016 to 2017.

| Topic: Capital losses in excess of capital gains. Fillable Schedule D Form 1040 Capital Gains And Losses 2012 Printable Pdf Download Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Explanation |

| File Format: DOC |

| File size: 5mb |

| Number of Pages: 8+ pages |

| Publication Date: March 2019 |

| Open Fillable Schedule D Form 1040 Capital Gains And Losses 2012 Printable Pdf Download |

|

And To report a capital loss carryover from 2016 to 2017.

11Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if applicable is less than zero. Now I mention xxxxx carryover loss in short term from 2016. Line 9 If line 8 is a net capital loss. 2016 Sample Tax forms J K Lasser s Your In e Tax 2017 Book from Capital Loss Carryover Worksheet source. But turbo tax software is giving me a refund based on those losses. For each of 2015-2017 review your returns to determine if you applied a net capital loss from a prior year on line 253 of your tax return.

Form 1040 Individual Ine Tax Return 2013 Brilliant Irs Gov Capital Gains Worksheet New Schedule C Tax Form 2018 4 19 15 Models Form Ideas Capital Gains and Losses IRS Tax Form Schedule D 2016 Package of from Capital Loss Carryover Worksheet sourcebookstoregpogov.

| Topic: Computation of Carryover. Form 1040 Individual Ine Tax Return 2013 Brilliant Irs Gov Capital Gains Worksheet New Schedule C Tax Form 2018 4 19 15 Models Form Ideas Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Synopsis |

| File Format: Google Sheet |

| File size: 1.8mb |

| Number of Pages: 27+ pages |

| Publication Date: April 2021 |

| Open Form 1040 Individual Ine Tax Return 2013 Brilliant Irs Gov Capital Gains Worksheet New Schedule C Tax Form 2018 4 19 15 Models Form Ideas |

|

S 1040 Pdf 1040 Federal 2016 Fd Wk D Cg Capital Loss Carryover 16 Pdf If you have more capital losses than capital gains in previous years part of those losses may be carried over to your 2020 tax return.

| Topic: 2016 Montana Net Operating Loss NOL 15-30-2119 MCA and ARM 4215318 ARM 4230106. S 1040 Pdf 1040 Federal 2016 Fd Wk D Cg Capital Loss Carryover 16 Pdf Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Explanation |

| File Format: PDF |

| File size: 1.6mb |

| Number of Pages: 5+ pages |

| Publication Date: April 2017 |

| Open S 1040 Pdf 1040 Federal 2016 Fd Wk D Cg Capital Loss Carryover 16 Pdf |

|

Schedule D Tax Worksheet 2014 Nidecmege Publication 550 Investment In e and Expenses Reporting Capital from Capital Loss Carryover.

| Topic: Enter amounts here that reflect taxable income prior to the application of an NOL carryback from a future year adjusted accordingly for capital loss deduction. Schedule D Tax Worksheet 2014 Nidecmege Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Explanation |

| File Format: DOC |

| File size: 5mb |

| Number of Pages: 7+ pages |

| Publication Date: May 2020 |

| Open Schedule D Tax Worksheet 2014 Nidecmege |

|

Fillable Online 6 Short Term Capital Loss Carryover Fax Email Print Pdffiller If Schedule D lines 15 and 16 are losses then you might have a capital loss carryover to 2020.

| Topic: Browse for the capital loss carryover worksheet 2017. Fillable Online 6 Short Term Capital Loss Carryover Fax Email Print Pdffiller Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Synopsis |

| File Format: Google Sheet |

| File size: 1.7mb |

| Number of Pages: 4+ pages |

| Publication Date: November 2019 |

| Open Fillable Online 6 Short Term Capital Loss Carryover Fax Email Print Pdffiller |

|

2020 Form Irs 1040 Schedule D Fill Online Printable Fillable Blank Pdffiller Carryback of current year NOL to prior years may affect carryforward amounts for capital losses.

| Topic: If 2016 income included a capital loss adjust this amount accordingly. 2020 Form Irs 1040 Schedule D Fill Online Printable Fillable Blank Pdffiller Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Summary |

| File Format: Google Sheet |

| File size: 2.6mb |

| Number of Pages: 6+ pages |

| Publication Date: November 2020 |

| Open 2020 Form Irs 1040 Schedule D Fill Online Printable Fillable Blank Pdffiller |

|

Form 1041 Schedule D Capital Gains And Losses 2014 Free Download CAT 2017 registration opened on August 9.

| Topic: And To report a capital loss carryover from 2019 to 2020 Use this worksheet to figure the estates or trusts capital loss carryovers from 2020 to 2021 if. Form 1041 Schedule D Capital Gains And Losses 2014 Free Download Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Answer Sheet |

| File Format: PDF |

| File size: 6mb |

| Number of Pages: 8+ pages |

| Publication Date: May 2021 |

| Open Form 1041 Schedule D Capital Gains And Losses 2014 Free Download |

|

Tax Forms Irs Tax Forms Capital Gain If yes reduce the taxable capital gain on your spreadsheet by the loss applied.

| Topic: I was under the assumption that we can claim only 3k loss per year. Tax Forms Irs Tax Forms Capital Gain Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Learning Guide |

| File Format: DOC |

| File size: 810kb |

| Number of Pages: 29+ pages |

| Publication Date: April 2019 |

| Open Tax Forms Irs Tax Forms Capital Gain |

|

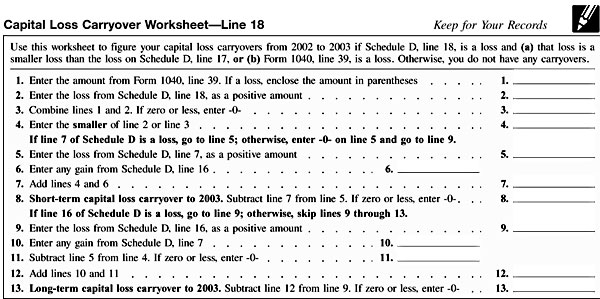

Schedule D Capital Loss Carryover Worksheet Line 18 For each of 2015-2017 review your returns to determine if you applied a net capital loss from a prior year on line 253 of your tax return.

| Topic: But turbo tax software is giving me a refund based on those losses. Schedule D Capital Loss Carryover Worksheet Line 18 Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Synopsis |

| File Format: DOC |

| File size: 1.6mb |

| Number of Pages: 29+ pages |

| Publication Date: November 2021 |

| Open Schedule D Capital Loss Carryover Worksheet Line 18 |

|

2016 Form 1040 Schedule D Edit Fill Sign Online Handypdf 11Use this worksheet to figure your capital loss carryovers from 2017 to 2018 if your 2017 Schedule D line 21 is a loss and a that loss is a smaller loss than the loss on your 2017 Schedule D line 16 or b the amount on your 2017 Form 1040 line 41 or your 2017 Form 1040NR line 39 if applicable is less than zero.

| Topic: 2016 Form 1040 Schedule D Edit Fill Sign Online Handypdf Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Synopsis |

| File Format: PDF |

| File size: 1.9mb |

| Number of Pages: 24+ pages |

| Publication Date: January 2021 |

| Open 2016 Form 1040 Schedule D Edit Fill Sign Online Handypdf |

|

S Ftb Ca Gov Forms 2016 16 540nrd Pdf

| Topic: S Ftb Ca Gov Forms 2016 16 540nrd Pdf Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Solution |

| File Format: DOC |

| File size: 2.3mb |

| Number of Pages: 24+ pages |

| Publication Date: December 2019 |

| Open S Ftb Ca Gov Forms 2016 16 540nrd Pdf |

|

Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller

| Topic: Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Answer |

| File Format: PDF |

| File size: 1.5mb |

| Number of Pages: 22+ pages |

| Publication Date: January 2019 |

| Open Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller |

|

Its definitely simple to prepare for capital loss carryover worksheet 2016 to 2017 S ftb ca gov forms 2016 16 540nrd pdf schedule d tax worksheet 2014 nidecmege fillable schedule d form 1040 capital gains and losses 2012 printable pdf download form 1041 schedule d capital gains and losses 2014 free download form 1041 schedule d capital gains and losses 2014 free download form 1040 individual ine tax return 2013 brilliant irs gov capital gains worksheet new schedule c tax form 2018 4 19 15 models form ideas 2016 form 1040 schedule d edit fill sign online handypdf 2020 form irs 1040 schedule d fill online printable fillable blank pdffiller

No comments:

Post a Comment